Those wanting to get into real estate and current landlords that are looking to hold their current residential properties to better hedge against inflation should consider positioning their portfolios differently so that they can endure the neverending supply chain disruptions, inflationary pressures, and rising interest rates.

Unlike the old days when investors had access to affordable financing, low utility costs, and a plentiful amount of inventory; investors cannot simply sell and jump on a new opportunity as easily as they used to. It’s time for them to hold onto what they have and adjust their rental property positioning accordingly. Those wanting to get in should look for creative cost-saving ways to rent.

Since resources are diminishing and utility costs are likely to rise, Investors need to make their operating costs lower so that they can remain solvent and profitable. If landlords are breaking even or worse, losing money each month because the cost to rent a home is too much, they will sooner or later be out of business.

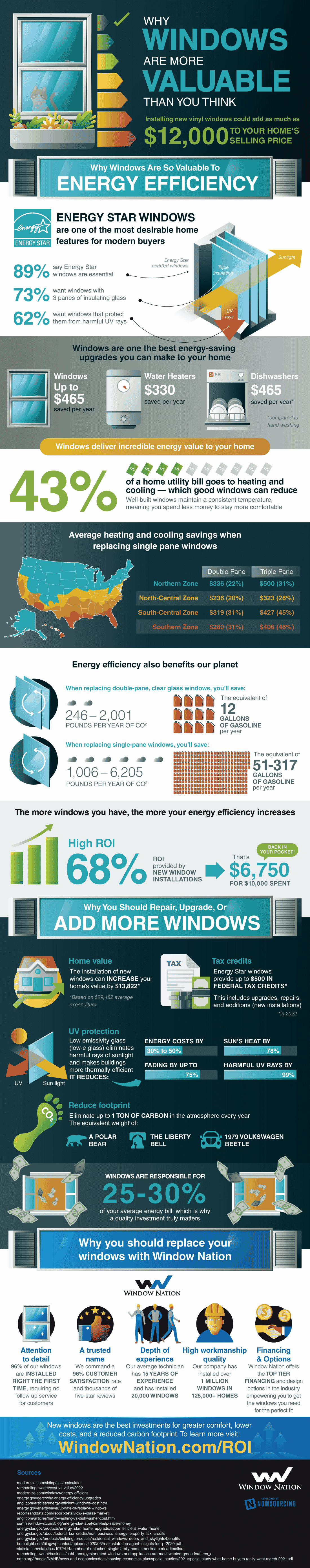

While this article is not meant to get doom and gloom, there is a solution for landlords and those looking to invest in a rental property to hedge themselves against inflation. Rather than adding extra sweat equity to save management costs, landlords should invest in UV protected/insulated windows to reduce utility costs.

Surprisingly, investing in insulated windows is more cost-efficient than reducing rental functions or making the effort to put in more sweat equity. In a recent study, homes with UV/insulated windows save an average home in the south $406 a year (not including other utility costs and tax savings). While this may not seem like a lot, the amount of houses saved in the south is almost half in comparison to what the energy bills used to be without insulated windows.

Although there are many other factors for landlords and potential real estate investors to consider when looking to better hedge themselves against inflation in real estate, cutting an energy bill almost in half while receiving tax benefits is a game changer. Even though insulated windows themselves do not keep up with inflation, their functionality to rental properties helps investors remain more solvent.

What’s even better is that these insulated windows that last and compound a landlord’s savings for decades can alleviate a landlord’s thin profit margins and give investors that want to be a landlord a better chance to do so where inventory is low and energy prices are still high. Learn how window replacement is a good investment in the infographic below:

Source: WindowNation.com