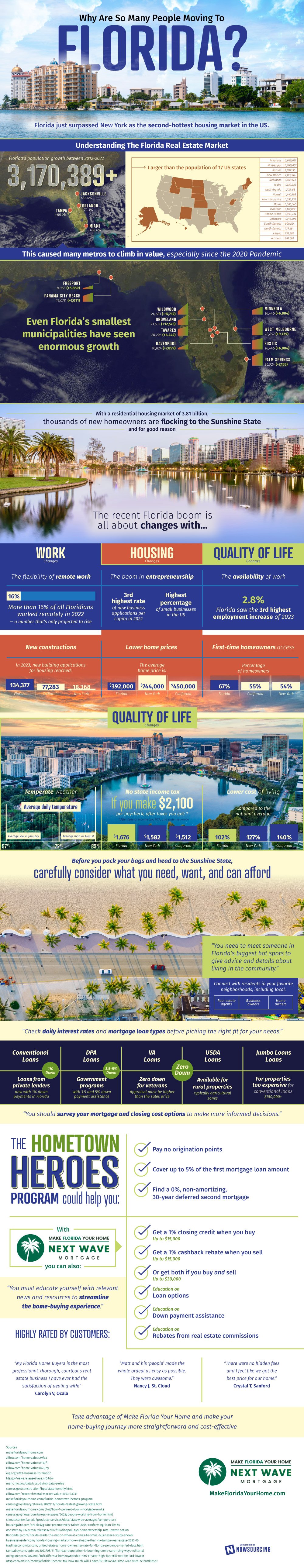

No matter where one chooses to buy a house, they’re going to have a few options on how they do so. What this usually means is choosing between different mortgages. This consists of two primary factors, daily interest rates and mortgage loan types.

Different loan types exist for different purposes. There are VA loans for veterans, USDA loans for rural property, and jumbo loans for expensive property. Some loans will have higher down payments, some lower. It’s all going to depend on the conditions of the person applying for the loan.

Mortgages also vary from state to state. Considering the different property values from, say, Florida to New York, they need different standards. Conventional loans in Florida can be as low as 1% down. This alongside no income tax makes Florida a more solid option for a home than some of the more expensive states. That’s why so many are moving to Florida, after all.

These are just the beginnings of considerations for a mortgage. Fortunately, there are programs that can help with this process. Many mortgage companies now pride themselves on providing education on options and assistance. Of course, some will be more honest than others, but the resources are out there. So when considering a mortgage, consider all options, even if that’s a challenge to do.