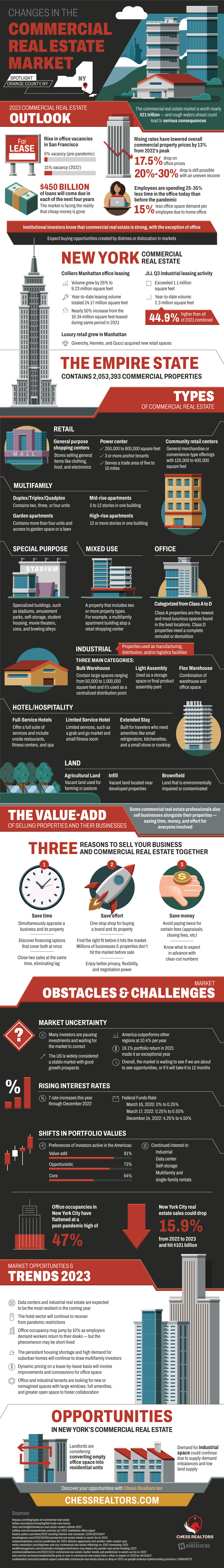

When the conversation of commercial real estate pops up there are many areas this covers. Most people may immediately go to office spaces, retail shops, and hospitals. This category also covers spaces such as multifamily units, amusement parks or zoos, industrial and land. While one of the common uses of commercial real estate, office spaces, has been seeing a downward trend, the other areas are seeing potential growth. One state in particular, New York, is seeing this current trend. In Manhattan, New York luxury retail has grown, and landlords have been looking into converting office spaces into rental units.

Some of the issues commercial real estate has found itself facing has come as a result of the pandemic. Pre Pandemic the numbers were not as daunting, for example, In San Francisco office vacancies were at 6%. In 2022 the number of office vacancies rose to 15%. These vacancies may be the result of remote work and the push towards keeping this option more permanent. New York, in particular, is seeing some very positive trends going into 2023. New York office spaces have seen an increase in volume by 26%, with a leasing volume of 24,17 million square feet. The industrial section in New York has seen a 44.9% higher volume in square feet over the year 2021 alone.

Investors in New York know their state has strong possibilities when it comes to commercial real estate. The opportunities are endless with the different categories that are fulfilled by commercial real estate. With a demand in focusing more on our supply-chain New York may see a boom in their industrial commercial real estate. This can focus on bulk warehouses, assemblies, and flex warehouses. What has been found is that with the issues brought to light from the pandemic has pushed for resolution and commercial properties can lend a hand.

One of the big benefits to commercial real estate is that it provides the potential to sell real estate along with a business. There are three reasons to sell property this way, it includes saving time, saving effort, and saving money. You can save time by simultaneously getting appraisals for both a business and a property along with saving time to find a loan to cover both. By combining property and business you can also save on effort by not having to repeat steps or change up your plan, it will all be done at once. You can also save money by not having to pay twice on fees such as application and closing.

Source: ChessRealtors.com